Andrew Doran | Global Chief Underwriting and Claims Officer | 14 November 2023

Underwriting processes, practices and philosophies are changing with faster pace than we have ever experienced before. Aside from the introduction of underwriting rules engines around 15 years ago, changes within underwriting have generally been steady evolution rather than radical revolution. This, of course, varies by market, but in the last one to two years the pace of change has noticeably accelerated.

With customers and advisers continuing to trend towards a fully digital experience, and the increasing demand for AI within life and health underwriting, traditional underwriting practices continue to be viewed as a barrier to doing business easily and quickly in today’s digital-first environment.

Where is underwriting today?

The question of where underwriting is today can sometimes be almost impossible to answer concisely. Depending on where you look, this varies enormously. There are relatively small pockets where life and health underwriting has been radically overhauled, but for most a more traditional approach is still being taken:

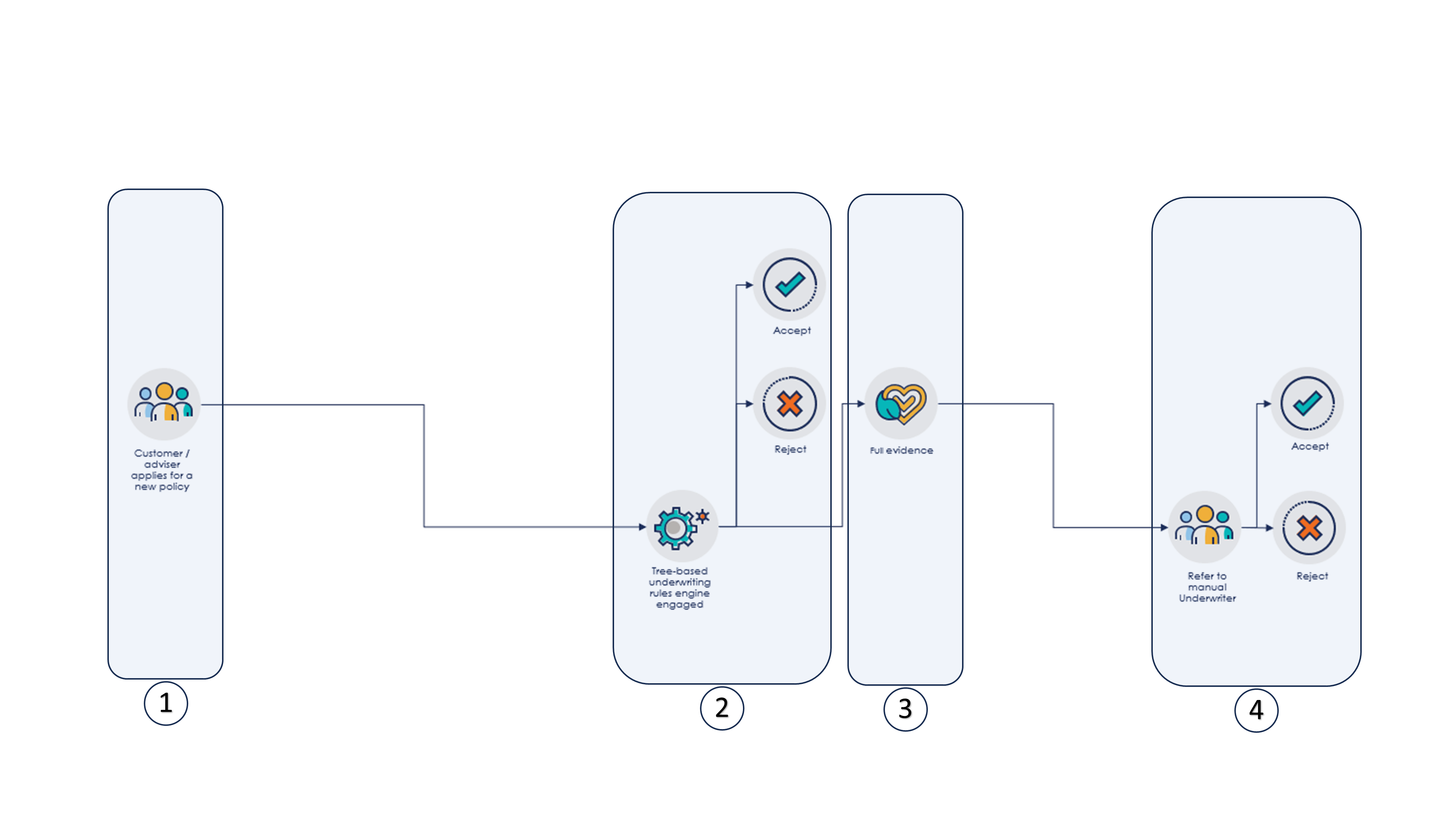

- An adviser or customer completes a questions-and-answer style application form

- A tree-based rules engine processes the answers to make an automated decision – achieving between 40% – 80% straight through processing (STP)

- Underwriting evidence may be called for the remaining 20% – 60%

- A human underwriter reviews the evidence to make a final decision.

As insurers and re-insurers continue to focus on underwriting enhancements, there are three questions I hear most often:

Can AI be used to replace underwriting?

Can alternative technology replace traditional underwriting requirements?

Can insurers utilise alternative data sources to replace underwriting?

More commonly now, question one has become, “Can Chat- GPT be used to replace underwriting?”. The answers to all these questions are almost certainly YES, but with some qualification to that answer.

Whilst there is an almost universal acknowledgment that AI, advanced technology and data analytics are playing an ever-increasing role within underwriting and claims practices, there is still a place for more traditional human-based medical underwriting. We have been witnessing the benefits of data analytics within underwriting for some years now, but augmentation rather than replacement is still almost certainly the future for a while to come.

What should we expect underwriting to look like in the future?

If the recent past is indicative of the future direction, we can expect to experience quite radical evolution over the next 10 years, from the simplicity of the above to the complexity of the below.

The comparison with the previous underwriting process flow is stark, where we see a synergetic relationship between data, analytics, technology, and human underwriters, as customers navigate from application submission to final underwriting decision, and purchase of insurance. This can be summarised under five themes.

1. Predictive underwriting – utilising traditional and non- traditional data sources to segment risk and drive bespoke underwriting question, from zero questions to full underwriting.

2. Augmented underwriting rules engines – tree-based rules engines are incredibly effective to a point but require augmentation with machine learning models to boost STP beyond what is possible through traditional rule development activities.

3. Technology – supplementing or replacing traditional underwriting evidence requirements, for example the use of video technology to replace traditional medical exams.

4. Complex reasoning engines – AI capability built to accept digitally acquired medical evidence which is then automatically read and understood to produce a reasoned outcome in a similar way to a human underwriter.

5. Human underwriters – dealing with the most complex case where their deep technical knowledge adds the most value to customers and advisers.

Many underwriting journeys will only utilise certain elements of the above, and we are seeing this already in different markets. For example, in Malaysia health claims data is used extensively to predict risk and offer very short, or even zero question, applications to customers. In Singapore video technology is used to speed up the medical exam process. And in the UK and Singapore machine learning algorithms are used to reduce Underwriting Rules Engine (URE) referral ratesby predicting those who are more likely to be standard rates instead of being referred to an underwriter.

Eventually we’ll get to the stage where we’ll see the one- question underwriting journey which simply seeks the customers permission to access their data (medical or otherwise), removing the need for traditional Q&A style underwriting.

Regardless of the path taken by individual companies, the ones that will be the most successful will be those who are able to navigate regulation changes and have the right technology in place to seamlessly connect all these elements together, in real- time.

So, what does this mean for the role of an underwriter?

Certainly, AI will continue to play a major role within underwriting now and in the future. But when thinking about ‘the future of underwriting’, there are other things to be considered, not least the role of an underwriter.

With the introduction of UREs, underwriters’ roles already began to change many years ago. From manual assessment of both simple and complex cases to assessing only the complex cases which UREs could not handle.

Therefore, underwriting roles were created with focus on underwriting strategy, rules design, question structure and optimization, and ultimately using underwriting as a commercial tool, rather than just as a new business process.

With the emergence of alternative data sources, machine learning AI technology and the use of third-party technologies, some underwriting roles will need to pivot again, to act as the key conduits between data science and traditional underwriting.

Not data scientists per se, but having sufficiently detailed understanding of data analysis techniques, terminologies and outputs will become essential for the next generation of underwriting development departments if they are to continue to drive the optimization of underwriting practices.

The below illustration, from recent work undertaken between our underwriting and data science teams at Pacific Life Re, brings this to life. This is a graphical representation of the output from a machine learning model demonstrating the importance of cardiovascular underwriting features to whether a final underwriting decision is more or less likely to be standard rates.

The International Classification of Diseases for Oncology (ICD-O) behaviour

Underwriters do not necessarily need to be able to produce this output, but rather be able to interpret, understand, and have the confidence to offer insight and challenge to what is being presented.

Whilst daunting, it brings an exciting opportunity for underwriters who love data analysis to further broaden and enhance their skills. Underwriting leaders need to bring some of their team members on that journey now, to begin to equip them with these skills and ensure they remain relevant to the direction of travel.

Be open-minded, but cautious

I know from personal experience that it is often easy to get carried away with the potential that modern technology brings to our field, and whilst we should remain curious and open-minded, there are three areas where I would urge some caution.

Whilst we have seen the emergence of regulation (e.g., in the EU, the US and in China) there is still a lack of clarity on the future of AI regulation. It can often be perceived as a black box; therefore, ensuring explain-ability remains a key component of any development is crucial for insurers to continue to fairly justify underwriting outcomes.

The upside of using technology and data innovation within underwriting is clear, but that also comes with risks around asymmetry of information and anti-selection, so ensuring you have robust processes to monitor changes in behaviour, underwriting outcomes and mix of business becomes even more essential.

And lastly, avoid becoming too clever, and creating solutions for problems that never existed in the first place. Just because you can, does not mean you should.

Conclusion

This is a topic I think about a lot, every day really, and whilst at times ‘the future of underwriting’ can be quite uncertain and frankly scary, we’re in one of the most exciting times to be part of the underwriting and claims profession. The things that I know I have dismissed as impossible many years ago are now happening, and this brings opportunities for us to not only understand underwriting risk better, but develop ourselves, expand the reach of insurance, and make underwriting the reason people chose to buy, rather than the barrier many see it as today.

Pacific Life Re Limited (No. 825110) is registered in England and Wales and has its registered office at Tower Bridge House, St Katharine’s Way, London, E1W 1BA. Pacific Life Re Limited is authorised and regulated by the Financial Conduct Authority and Prudential Regulatory Authority in the United Kingdom (Reference Number 202620). The material contained in this booklet is for information purposes only. Pacific Life Re gives no assurance as to the completeness or accuracy of such material and accepts no responsibility for loss occasioned to any person acting or refraining from acting on the basis of such material.

©2024 Pacific Life Re Limited. All rights reserved.

Andrew Doran

Global Chief Underwriting & Claims Officer

.png)

.png)

.png)