This website uses cookies for a variety of purposes including to help improve our website, and for other reasons as set out in our privacy policy. By using our website, you acknowledge and consent to the use of essential and analytics cookies, as described in our Cookie Policy. To understand more about how we use cookies or to change your preference and browser settings, please see our Cookie Policy.

Underwriting | 30 August 2023

The change of nomenclature

The pituitary gland is a small, pea-sized gland located below the base of brain and connected to the brain via a ‘stalk’. It’s the master gland of the endocrine system and regulates the functions of the endocrine (hormone secreting) glands throughout the body. Pituitary adenoma is the most common type of tumour that develops within the pituitary gland. Most are non-functioning (no interference with hormones) and / or asymptomatic and are named as ‘incidentalomas’.

A recent review by WHO resulted in reclassification of pituitary adenoma as described below.

Under the 5th Edition of the WHO Classification of tumours of the pituitary region, the terminology 'Pituitary Adenoma' shall be renamed as 'Pituitary Neuroendocrine Tumour', or in short PitNET.

The International Classification of Diseases for Oncology (ICD-O) behaviour code for PitNET (effective from January 2023) is now revised from "0" to "3", which indicates a change from benign to malignant disease.

The previous terminology of Pituitary Carcinoma is also changed to the term Metastatic PitNET.

The possible impacts on claims for cancer benefit

The current situation

For critical illness and cancer only policies where a lump sum payment is paid upon the diagnosis of cancer, claims for pituitary adenoma would not be paid. This is because the condition is classified as a benign tumour... However, if the tumour has metastasised then the cancer claim is payable under the term of pituitary carcinoma, which accounts for approximately 0.2% of all pituitary tumours.

New classification

Under the 5th WHO classification, pituitary adenoma is now renamed as a pituitary neuroendocrine tumour and classified into the category of a malignant disease. This gives rise to the potential that it could now be covered under the cancer benefit of CI and cancer-only products, based on the general cancer definition in the majority of markets.

The epidemiology of pituitary gland tumours is interesting and shows a significant difference across various studies.

According to a large-scale US population-based study(1), the overall standardised incidence rate was approximately 5 cases per 100,000 persons per annum. However, the prevalence rate varies widely across demographic variants. One study indicates the prevalence of the disease in UK is 76-116 per 100,000 population, approximately 1/1,000, but a high incidental finding of pituitary adenoma at autopsy, ranging from 1.5% to as much as 30%, is reported.

If these reclassified ‘malignant’ pituitary tumours are considered to be covered under the cancer benefit, an assessment of the impact of these extra claim cases beyond pricing assumptions needs to be carefully considered.

Pacific Life Re's view on claims assessment of pituitary adenoma

Since 1932, Harvey Cushing first proposed pituitary adenoma as the cause of acromegaly. The disease is recognised as a benign tumour, which can be easily cured or controlled by conventional therapies, including surgery, radiotherapy and/or medical treatment.

A large proportion of the cases, which are identified incidentally and exhibit no symptoms, do not require any treatment. In these cases, periodic surveillance is the only medical measure required. Other than pituitary carcinoma (metastatic PitNET), only a very small subset of pituitary adenomas present aggressively in nature, which means rapid growth rate and being refractory to optimised standard treatment.

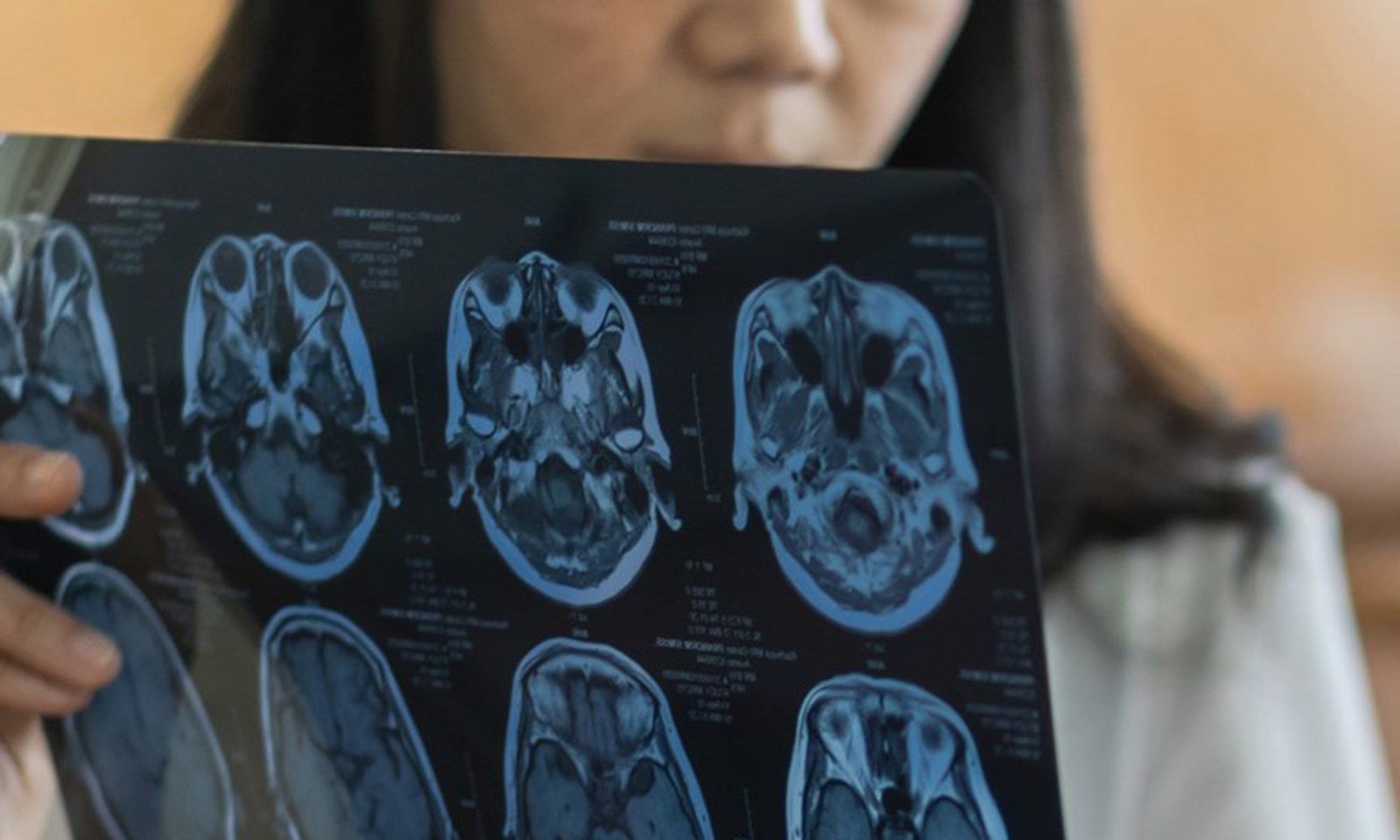

In the cancer definition, any malignant tumour must be positively diagnosed with histological confirmation.

In cases where no clinical treatment is required, or non-invasive treatment is the only medical measure to take, these tumours will not be diagnosed through histological methods.

A key point is that whilst being reclassified by WHO as malignant, these tumours exhibit variable growth patterns across a spectrum of malignant behaviour, with the vast majority exhibiting indolent and non-aggressive behaviour.

The change by WHO from benign to malignant is not representing a new disease process, it is a nomenclature change, a reclassification of previously considered benign adenoma to overt malignancy. The WHO reclassification will not influence the associated risk or clinical pathway because the diagnostic label has been amended. These are the same (previously labelled) adenomas brought into line under one new heading.

Therefore pituitary tumours without histological proof, or the necessity of specific cancer treatment such as surgery or radiation therapy, are beyond the scope of cancer coverage that CI policy reasonably intends to pay.

We would advise that any particularly unusual or ‘grey’ claims are referred to Pacific Life Re for opinion.

Underwriting of pituitary adenoma

As the change of the name and reclassification of tumour category do not affect the natural diagnosis, when underwriting a critical illness or cancer product, we need to consider that pituitary adenoma is now potentially a cancer risk.

Even in the case of non- functioning (not affecting hormone balance) and minor tumours, an exclusion of pituitary tumour is recommended to apply to the policy.

For those more aggressive cases with rapid growth rate or resistant to treatment, a more cautious underwriting outcome should be considered.

Our current view is that income protection and medical reimbursement (e.g. Medex) products are not materially impacted considering the natural diagnosis approach, and the treatment standard of pituitary adenoma not changing due to the WHO’s reclassification.

In the meantime, we advise that underwriters exercise caution when assessing critical illness or cancer only products where a history of pituitary adenoma or PitNET is found, and to refer to us for any further guidance on individual cases.

Next steps

It is acknowledged that this reclassification of disease has created some challenges and will evolve further over the coming months.

We are continuing to work through the various possible impacts and will be engaging with and supporting our clients in relation to their specific needs in this area.

Pacific Life Re Limited (No. 825110) is registered in England and Wales and has its registered office at Tower Bridge House, St Katharine’s Way, London, E1W 1BA. Pacific Life Re Limited is authorised and regulated by the Financial Conduct Authority and Prudential Regulatory Authority in the United Kingdom (Reference Number 202620). The material contained in this article is for information purposes only. Pacific Life Re gives no assurance as to the completeness or accuracy of such material and accepts no responsibility for loss occasioned to any person acting or refraining from acting on the basis of such material.

©2024 Pacific Life Re Limited. All rights reserved.

Andrew Doran

Chief Underwriting Officer

Paul Reddick

Principal Underwriter

Discover more Vital Insights

Protection

Changing regulations an area of opportunity for reinsurers

When asked what opportunities life reinsurers in Asia have, Pacific Life Re's Vasan Errakiah was quick to cite demand for insurance, changing regulations and the adoption of new technologies.

.png)

Protection

Solving the implementation puzzle of machine learning

Asia Insurance Review spoke to Pacific Life Re's Mr Ong Qian Hao and FWD Group's Ms Fiona Hermans to understand how strategic partnerships can effectively address these challenges and lead to successful outcomes.

Medical Advances

Update on COVID-19 and Long Covid

Read our update on the impact of mortality from COVID-19.

Medical Advances

Lung cancer screening, marginal gains or a game changer?

Lung cancer is often diagnosed at a late stage leading to poor prognosis for the individual. We look at how screening could have an impact.

Underwriting & Claims

From Barrier to Benefit: Rethinking the Future of Underwriting

Underwriting has been going through significant transformation over the last few years and continues to accelerate at an unprecedented pace. Traditionally seen as a barrier, there is now a growing opportunity to position underwriting as a strategic asset.

Protection

Leveraging big data insights in reinsurance

Big data analytics has been instrumental for (re)insurers aiming to boost performance, efficiency, and effectiveness.

Medical Advances

Vital Insights Issue 2

From emerging drugs which battle obesity to a review of the effectiveness of new blood tests both to detect cancer and to help slow down Alzheimer’s, we hope these insights help keep you up to date with the latest in medical research.

Medical Advances

Vaping vs. smoking: what are the risks?

Vaping is generally considered less harmful than smoking, however longer-term risks have not had time to emerge and could prove considerable.

Medical Advances

Gut Check: the concerning rise of bowel cancer among young adults

Despite broadly improving cancer mortality, some types of the disease are increasing in incidence

Protection

Serving the Underserved

Consumer Duty has put increased focus on how much value different customers get from financial products. But how well is the protection industry serving different customer groups? Who are the most underserved groups, and what can the industry do to help serve these groups better?

Underwriting & Claims

The future of underwriting is now... are we ready?

Underwriting processes, practices and philosophies are changing with faster pace than we have ever experienced before.

Medical Advances

Tackling the obesity crisis

A new generation of drugs has now well and truly arrived aiming to improve weight loss. The drugs are heavily touted by celebrities and influencers, despite many of them having no medical need to lose weight. Obesity contributes significantly to some of the most common causes of death including heart disease and cancer, as well as affecting quality of life for millions. In this article we look at these increasingly available drugs offering hope to more people with obesity. We consider their potential to broadly improve health, and their limitations.

Medical Advances

New drug may slow down multiple sclerosis

Scientists successfully conducted early-stage trials which provide hope of a future cure for some of the most severe types of multiple sclerosis (MS).

Medical Advances

Exploring the latest medical advances in cancer detection

The world’s largest conference dedicated to the science and treatment of cancer took place in Chicago in early June. The American Society of Clinical Oncology’s annual meeting is a popular forum at which new scientific developments are often revealed.

Medical Advances

Pituitary Neuroendocrine Tumour (PitNET)

A recent review by WHO resulted in reclassification of pituitary adenoma as described in the article

Medical Advances

Climate change and its impact on mortality and morbidity

In 2023 we’ve seen soaring temperatures across the globe along with devastating storms and wildfires. Why is our climate changing and what impact is it having?

Medical Advances

Vital Insights Issue 1

Welcome to our first edition of Vital Insights. Here we’ve put together a collection of articles covering some of the major issues of the day with a specific focus on how they will impact mortality and morbidity.

Medical Advances

Deep dive: Alzheimer's

Total deaths from dementias in high-income countries have almost quadrupled in the last 20 years, yet so far medical science has very few answers. This article looks at the recent emergence of the first drugs which may be able to modify the effects of this terrifying disease

Medical Advances

New Respiratory Syncytial Virus Vaccine

COVID-19 has stolen the limelight from other respiratory viruses in recent years. However there are plenty of other common viruses which can have serious health consequences, among them Respiratory Syncytial Virus, or RSV.

Medical Advances

An end in sight for AIDS

A new UN report reveals optimism about a possible end to the global AIDS epidemic

Medical Advances

Anti-vaccine sentiment increases risk of measles outbreaks

Vaccine technologies have continued to improve greatly in recent years. However, vaccines are little use if people refuse to use them. Here we look at the precarious position of measles, a well-known but little-understood serious condition, which is held in check in most countries only because of high vaccine uptake.

Medical Advances

Does a common sweetener cause cancer

The International Agency for Research on Cancer (IARC), the cancer research arm of the WHO, recently classified the common sweetener aspartame as a possible cause of cancer in humans.

Protection

Building a sustainable protection market

Beneath the Surface report 2023 We explored some of the key drivers of sustainability for the protection market. We undertook consumer research which combined with our medical and underwriting expertise and our deep understanding of the market, enabled us to create this report.

.png)

Protection

Navigating the ocean of Value-Added Services

Beneath the Surface report 2022 In this report, we analyse the current VAS landscape in the UK & Irish protection markets. Look to understand the views and experiences of customers, with the aim of assessing how much value these services are really adding today. Look at what insurers say, and consider what the future might hold for the development of VAS.

.png)