앤드류 도란 (Andrew Doran) | 언더라이팅 및 클레임 글로벌 총괄, 퍼시픽라이프재보험 | 14 November 2023

언더라이팅 프로세스, 실무 및 철학은 우리가 경험했던 그 어느 때 보다 빠르게 변화하고 있습니다. 대략 15년 전 언더라이팅 룰엔진이 도입되었던 것을 제외하고는 언더라이팅 내에서의 변화는 일반적으로 급진적인 변화라기 보다는 점진적인 진화였습니다. 그러나, 물론 시장에 따라 편차는 있으나, 최근 1~2년 동안 변화의 속도는 뚜렷하게 가속화 되었습니다.

고객과 보험전문가들이 전적인 디지털 경험을 추구하는 추세를 이어가고 있고, 생명 건강보험 분야의 언더라이팅에서 인공지능(AI)에 대한 수요가 증가하고 있는 가운데 전통적인 언더라이팅 업무는 오늘날의 디지털 중심 환경에서 비지니스를 쉽고 빠르게 처리하는데 계속해서 장애물로 여겨지고 있습니다.

언더라이팅의 현주소는 어디인가?

언더라이팅의 현주소가 어디인지에 대한 질문에 간결하게 답하는 것은 쉽지 않은 일입니다. 어느 부분을 보느냐에 따라 크게 다를 수 있습니다. 일부 영역에서 생명건강보험 언더라이팅이 급격하게 전면 개편되긴 했으나, 대부분의 영역에서는 전통적인 접근 방식은 아직도 다음과 같이 진행되고 있습니다

- 보험설계사 또는 고객이 문답 형식의 청약서를 작성

- 트리 기반 (Tree-based) 룰엔진이 답변을 처리하는 자동심사 – 40~80% 수준의 자동심사율(STP, Straight through processing)을 달성

- 나머지 20% ~60% 청약건에 대해 필요 시 심사자료 요청

- 언더라이터가 자료검토 후 최종 심사결정

보험사 및 재보험사가 계속해서 언더라이팅 개선에 초점을 맞추고 있는 가운데 가장 자주 듣는 세가지 질문이 있습니다.

- AI 사용이 언더라이팅을 대체할 수 있는가?

- 대체 기술이 전통적인 언더라이팅 필수 심사자료를 대신할 수 있는가?

- 보험사는 언더라이팅을 대체하기 위해 대안적인 데이터 자원를 활용할 수 있는가?

최근에 질문1은 조금 더 일반적으로 “Chat-GPT 사용이 언더라이팅을 대체할 수 있는가?”로 변화 되었습니다. 이 모든 질문에 대한 답은 거의 확실하게 ‘예’이지만 그 답변에는 일부 조건이 따릅니다.

언더라이팅 및 클레임 업무에서 AI, 첨단기술 및 데이터 분석 역할이 계속해서 증가하고 있는 것은 보편적으로 인정되는 사실이나, 좀 더 전통적인 언더라이터 기반의 메디컬 언더라이팅은 여전히 존재합니다. 수년간 언더라이팅 분야에서 데이터 분석의 효용이 확인되고 있으나, 언더라이팅을 대체하려면 시간이 걸릴 것입니다.

미래 언더라이팅에 대하여 우리는 무엇을 예상할 수 있는가?

최근의 경험에서 미래의 방향성을 볼 수 있다면, 향후 10년간은 위에서 언급한 단순한 언더라이팅에서부터 아래의 복잡한 언더라이팅으로의 상당히 급진적인 진화를 경험할 것으로 예상됩니다.

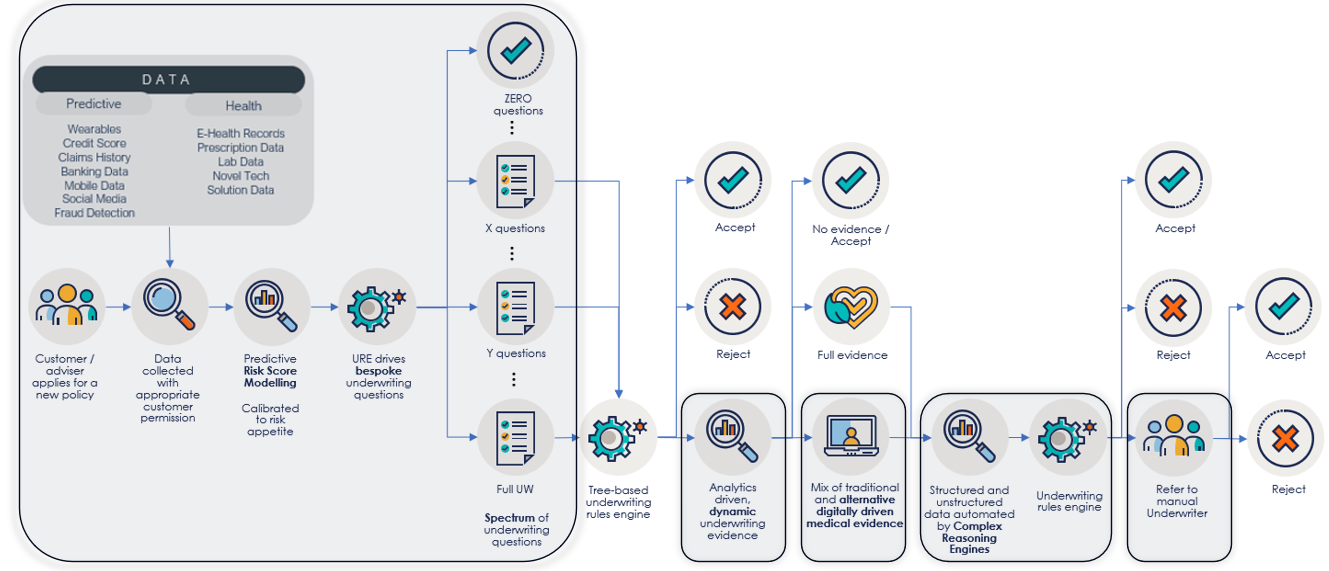

이전 언더라이팅 프로세스 흐름과의 비교는 뚜렷하게 나타납니다. 고객의 청약-심사-보험계약체결 과정에서, 데이터, 분석, 기술 및 언더라이터는 서로 시너지를 발휘하며 상호작용하고,

이는 아래 5개 주제로 요약할 수 있습니다

- 예측 언더라이팅(Predictive underwriting) – 위험을 분류하고, 고지질문이 없는 무심사 상품부터 표준체 상품까지 맞춤형 언더라이팅

- 언더라이팅 룰 엔진 개선 – 트리 기반(Tree-based) 룰엔진은 어느 정도까지는 매우 효과적이나, 전통적인 룰 개발 활동을 통해 가능한 것 이상으로 자동심사율(STP)를 향상시키기 위해서는 머신러닝모델을 통한 보강 필요

- 기술 – 전통적인 언더라이팅 심사자료 사항을 보완하거나 대체, 예시 - 비디오 기술을 활용해서 건강진단을 대체

- 복합적 사고 엔진(Complex reasoning engines) – 디지털화된 의료자료를 받고, 자동으로 읽고 이해하여, 언더라이터와 유사한 방식으로 합리적인 결과를 도출 할 수 있는 능력을 탑재한 AI

- 언더라이터 – 심도있는 기술적 지식으로 고객 및 보험설계사에게 가장 큰 가치를 부여할 수 있는 난이도 최상의 복잡한 심사건을 처리

다수의 언더라이팅 과정에서 위의 일부 요소들만 활용되는데, 이미 활용하고 있는 나라들이 있습니다. 예를 들어, 말레이시아에서는 건강보험 청구 데이터를 활용해 리스크를 예측하고 고객에게 초간편 고지질문지, 심지어는 무심사 청약을 제공하고 있습니다. 싱가포르에서는 건강진단 과정을 가속화하기 위해 비디오 기술이 사용되고 있습니다. 영국과 싱가포르에서는 머신러닝 알고리즘을 활용하여 언더라이터의 심사를 거치는 대신 표준체 (Standard Rate)로 인수될 가능성이 높은 청약자를 예측함으로써, 언더라이팅 룰엔진에서 인심사 의뢰비율을 낮추고 있습니다.

결국, 고객의 데이터(의료 및 기타정보)에 접근하기 위해 고객의 동의를 구하는 단일 질문의 언더라이팅 단계에 도달하게 될 것으로, 전통적인 Q&A형식의 언더라이팅의 필요성에서 벗어나게 될 것입니다.

개별 보험사가 어떤 경로를 선택하든 가장 성공할 회사는 규제 변화에 대응하고 이런 요소를 실시간으로 원활하게 연결할 수 있는 적절한 기술을 갖춘 회사일 것입니다.

그렇다면, 언더라이터 역할에 대하여 이것은 무엇을 의미하는가?

확실히 AI는 현재와 미래의 언더라이팅에서 주요한 역할을 계속 할 것입니다. 그러나 ‘언더라이팅의 미래’를 생각할때 특히 언더라이터의 역할을 비롯해 고려해야 할 다른 요소들이 있습니다.

언더라이팅 룰엔진의 도입으로 언더라이터의 역할은 이미 수 년 전부터 변화하기 시작했습니다. 언더라이터가 단순한 심사건과 복잡한 심사건을 모두 수동으로 평가하는 방식에서, 룰엔진이 처리할 수 없는 복잡한 심사건만 평가하는 방식으로 변화하고 있습니다.

그러므로, 언더라이팅 역할은 언더라이팅 전략, 룰 설계, 질문지구조 및 최적화에 중점을 두어 설계되었으며, 궁극적으로는 언더라이팅을 단순히 새로운 비지니스의 프로세스가 아닌 사업적인 도구로 활용하기 위함입니다.

대체 데이터 자원, 머신러닝 AI 기술 및 제 3자 기술의 등장으로, 일부 언더라이팅 역할은 데이터 과학과 전통 언더라이팅 간의 핵심 통로 역할을 수행 할 수 있도록 다시 방향이 전환되어야 할 필요가 있을 것입니다.

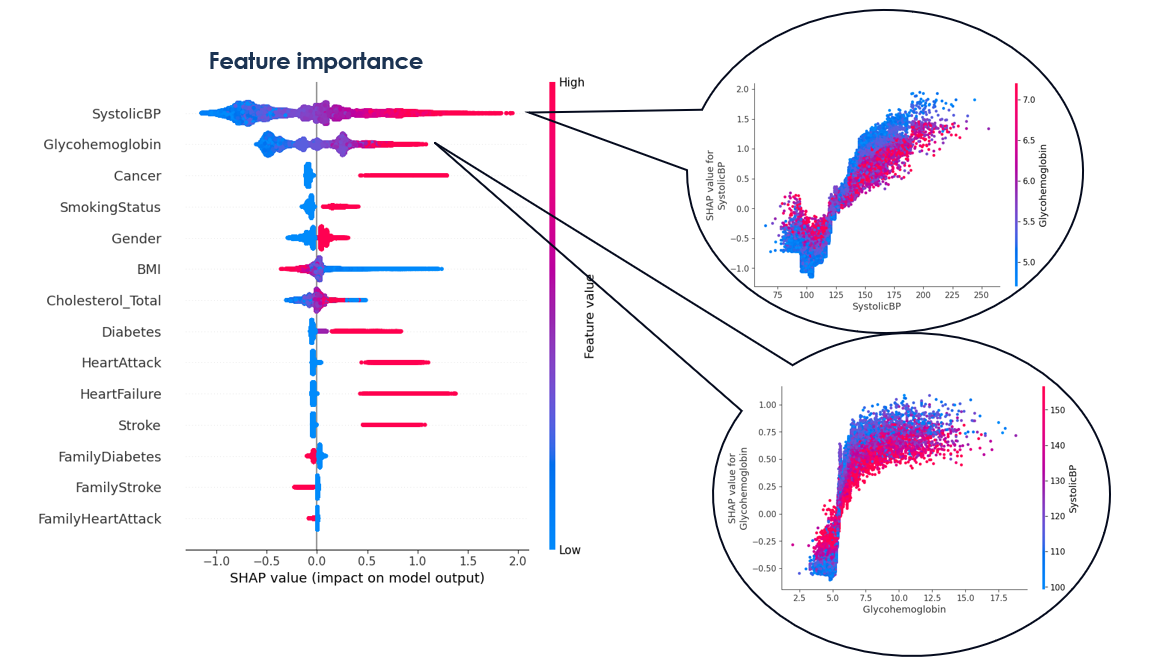

데이터 과학자는 아닐지라도 언더라이팅 업무의 최적화를 계속 추진하기 위해서는 데이터 분석 기술, 용어 및 결과에 대한 충분하고 상세한 이해를 갖추는 것이 차세대 언더라이팅 개발 부서에 필수 적일 것입니다. 아래 그림은 최근 퍼시픽라이프재보험의 언더라이팅 및 데이터과학 팀에서 실시한 작업으로 이를 잘 표현해 주고 있습니다.

머신러닝 모델의 결과를 그래픽으로 나타낸 것이며 최종 심사결과 표준체로 인수될 가능성이 얼마나 높거나 낮은 지에 대한 심혈관 언더라이팅 고려 요인의 중요도를 보여 주고 있습니다.

언더라이터가 이런 결과물을 직접 도출할 필요는 없지만, 제시된 내용에 대하여 해석하고 이해하며 제시된 내용에 대하여 본질적인 의미를 제공하고 의문을 던질 수 있는 자신감은 가지고 있어야 합니다.

The International Classification of Diseases for Oncology (ICD-O) behaviour

조금 두려울 수 있겠지만, 데이터 분석에 흥미가 많은 언더라이터에게는 본인의 능력을 더욱 확장하고 향상시킬 수 있는 좋은 기회를 제공할 것입니다. 언더라이팅 팀장들은 팀의 일부 부서원들을 지금 이 여정으로 이끌어 이러한 스킬을 갖추는 시작을 하도록 해야하며 그 여정의 방향과 연관성을 유지 할 수 있도록 해야 합니다. 링크드인(LinkedIn) 학습 (‘Data Science Foundation’ 검색)에서 콘텐츠를 탐색하는 것과 같은 간단한 시도는 기본 용어를

이해하고 데이터 과학 동료들이 왜 ‘파이썬(Pythons)’에 대하여 계속 이야기 하는지와 같은 질문에 답할 수 있도록 도와 줄 것입니다

오픈마인드, 그러나 신중하게

개인적인 경험을 통해 현대 기술이 언더라이팅 분야에 가져오는 잠재력에 대해 쉽게 빠져들 수 있다는 것을 저자도 알고 있습니다. 호기심을 유지하고 열린 마음을 가질 필요는 있지만, 몇 가지 주의가 필요한 세 가지 영역이 있습니다.

- 규제가 생겨나기 시작했으나 (예: 유럽연합, 미국 및 중국) 아직도 AI 규제에 대한 미래는 여전히 명확하지 않으며, 자주 블랙박스로 인식된다. 따라서 ‘설명 능력’이 모든 개발의 핵심요소로 유지되도록 하는 것이 보험사가 지속적으로 타당한 언더라이팅 결과를 도출하기 위해 매우 중요합니다.

- 언더라이팅에서 기술 및 데이터 혁신의 사용이 긍정적인 측면은 분명하지만, 이는 정보의 비대칭성 및 역선택에 따른 위험도 따릅니다. 따라서, 행동, 언더라이팅 결과 및 비지니스 구성의 변화를 모니터링 할 수 있는 견고한 프로세스를 확보하는 것이 더욱 중요해지고 있습니다.

- 마지막으로, 지나치게 자만하지 않고 처음부터 존재하지 않았던 문제에 대하여 해결책을 만들어내는 것을 피해야 합니다. 할 수 있다고 해서 반드시 해야 하는 것은 아닙니다.

결론

이 주제는 개인적으로 많이 생각하는 주제입니다. 사실 매일 생각하게 됩니다. ‘언더라이팅의 미래’가 매우 불확실하고 솔직히 두렵기도 하지만, 언더라이팅과 클레임 전문가로서 참여할 수 있는 가장 흥미로운 시기 중 하나일 것입니다. 수년 전 불가능 하다고 일축 했던 것들이 지금 현실로 일어나고 있으며 이 것은 언더라이팅 리스크를 더 잘 이해하는 것 뿐만이 아니라 스스로를 발전시키고, 보험의 영향을 확장시키며, 오늘날처럼 언더라이팅을 장애물로 여기는 것이 아니라, 사람들로 하여금 보험구매결정의 이유가 되게 만드는 것입니다.

Andrew Doran

Global Chief Underwriting & Claims Officer